CREDIT Suisse Group is cutting at least one-third of its investment-banking workforce and about 40 per cent of research staff in China just two months after agreeing to spend US$160 million to take full control of its securities business in the world’s second-largest economy.

Recent Posts

Most Popular

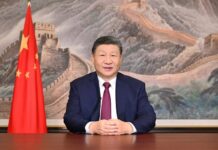

Xi says China to hit 2025 growth target of ‘around 5 per cent’

"We faced challenges head-on and strived diligently, successfully achieving the main goals of economic and social development," Chinese President Xi Jinping said in a...

One Punggol hawkers lament losing business to Punggol Coast Hawker Centre, hope new operator...

Timbre Group did not explain why it was cutting short its tenancy at One Punggol, said hawkers who met the operator on Monday.

Rupee bias tilts higher on final day of year on supportive Asia FX, momentum

The Indian rupee was biased higher on the final trading day of the year, due to supportive moves in Asian currencies...